STRIKEPOINT GOLD INC. BEGINS TRADING ON THE OTC MARKET

May 31, 2017, Vancouver, BC –StrikePoint Gold Inc. (TSX.V:SKP) (OTCQB:STKXF) (“StrikePoint” or the Company) is pleased to announce the company’s common shares have commenced trading on the OTCQB Market, under the symbol STKXF. StrikePoint will continue to trade on the TSX Venture Exchange under the symbol SKP. OTC Markets Group Inc., located in New York, N.Y., […]

STRIKEPOINT GOLD INC. ANNOUNCES APPOINTMENT OF ADRIAN FLEMING TO BOARD OF DIRECTORS

May 16, 2017, Vancouver, BC –StrikePoint Gold Inc. (TSX.V:SKP) (“StrikePoint” or the Company) is pleased to announce the appointment of Adrian Fleming to the Company’s board of directors. Adrian Fleming is a professional geologist with over 40 years of technical and executive experience with exploration and development stage mining companies. He was the co-founder and president […]

STRIKEPOINT GOLD INC. CLOSES $5 MILLION PRIVATE PLACEMENT AND WELCOMES ERIC SPROTT AS SHAREHOLDER

May 3, 2017, Vancouver, BC –StrikePoint Gold Inc. (TSX.V:SKP) (“StrikePoint” or the Company) is pleased to welcome Eric Sprott as a +10% shareholder and announce that it has closed on its $5-million non-brokered private placement (the “Financing”) as previously announced on April 18, 2017. Shawn Khunkhun, CEO of StrikePoint remarked, “We are very pleased to have […]

STRIKEPOINT GOLD INC. ANNOUNCES APPOINTMENT OF MICHAEL MCPHIE TO BOARD OF DIRECTORS

Strikepoint Gold Inc. has appointed Michael McPhie its board of directors. Shawn Khunkhun, chief executive officer, stated: “It is with great enthusiasm that I welcome Michael McPhie to the board of directors of Strikepoint Gold. Mr. McPhie epitomizes the consummate mining executive, making our team much stronger and validating our advancement in the Yukon.” Michael […]

STRIKEPOINT GOLD INC. NAMES ANDY RANDELL VICE PRESIDENT OF EXPLORATION AND WELCOMES THE ‘HIVE’ TEAM TO EXECUTE SUMMER EXPLORATION PROGRAM

April 27th, 2017, Vancouver, BC –StrikePoint Gold Inc. (TSX.V:SKP) (“StrikePoint” or the Company) Shawn Khunkhun, CEO of StrikePoint, stated: “The appointment of Andy Randell as Vice President of Exploration enables a strong move forward for the Strikepoint inaugural work program in the Yukon. Randell and the company share the same vision in the development of our […]

STRIKEPOINT GOLD INC. ANNOUNCES SALE OF BLACK RAVEN

April 24, 2017, Vancouver, BC –StrikePoint Gold Inc. (TSX.V:SKP) (“StrikePoint” or the Company) is pleased to announce that it has entered into an agreement to sell The Black Raven Property located in Northwestern Ontario to the Canadian Orebodies Inc. (TSX.V:CORE). Under the terms of the agreement, the purchase price for the Black Raven Property will be […]

STRIKEPOINT GOLD INC. ANNOUNCES $4.68 MILLION PRIVATE PLACEMENT

April 18, 2017, Vancouver, BC –StrikePoint Gold Inc. (TSX.V:SKP) (“StrikePoint” or the Company) is pleased to announce that is has arranged a $4,686,000 non-brokered private placement consisting of 12,331,578 Flow-Through Units (the “FT Units”) at an issuance price of $0.38 per FT Share. Each FT Unit will consist of one flow through common share and one […]

STRIKEPOINT GOLD INC. CLOSES $3 MILLION PRIVATE PLACEMENT

April 4, 2017, Vancouver, BC –StrikePoint Gold Inc. (TSX.V:SKP) (“StrikePoint” or the Company) is pleased to announce that is has closed on its $3,000,000 non-brokered private placement as previously announced on March 23, 2017. The private placement consisted of 6,779,664 Flow-Through Shares (the “FT Shares”) at an issuance price of $0.295 per FT Share for total […]

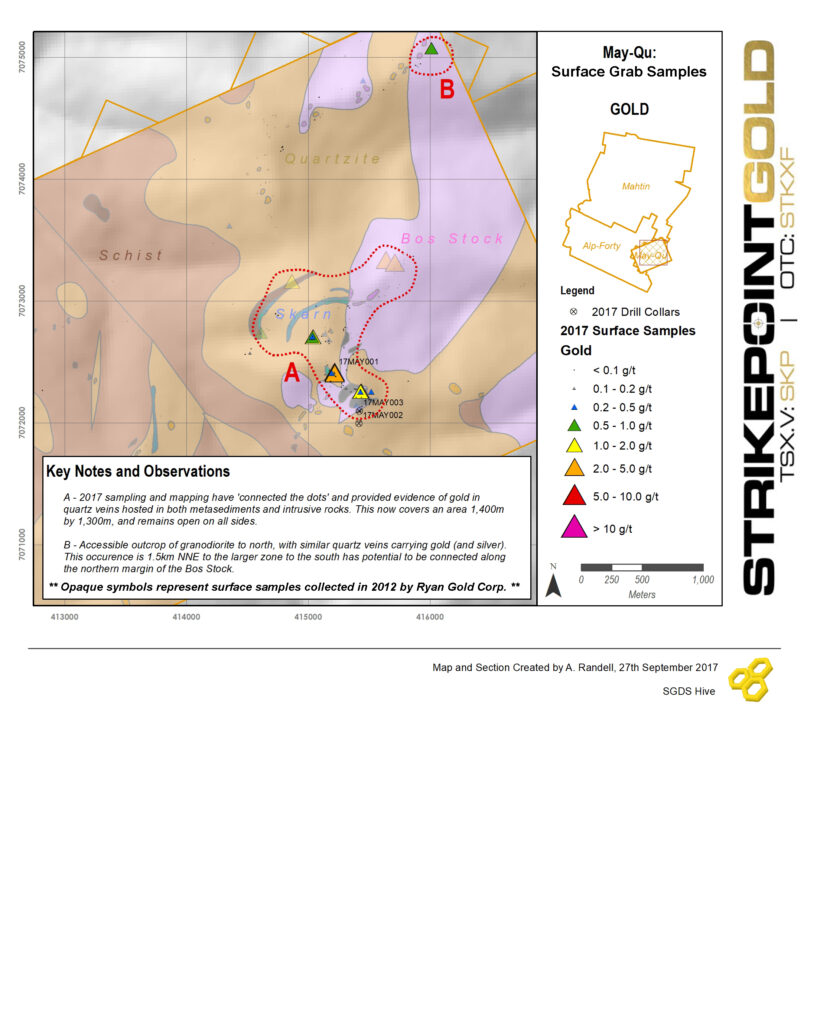

STRIKEPOINT GOLD 2017 UPDATE: EXPLORATION TARGETS FINALIZED FOR RECENTLY ACQUIRED YUKON PROPERTIES

March 31, 2017, Vancouver, BC –Strikepoint Gold Inc. (TSX.V:SKP) (“Strikepoint” or the Company) is pleased to announce exploration targeting for the recently acquired Yukon Portfolio. This package was acquired from IDM Mining (TSX.V:IDM) through: a Letter of Intent on December 21st, 2016; signed into Definitive Agreement on January 19th, 2017; and Completed Purchase Agreement on March […]

March 28. 2017

STRIKEPOINT COMPLETES PURCHASE OF YUKON PORTFOLIO FROM IDM MINING

March 28, 2017, Vancouver, BC – StrikePoint Gold (TSX.V:SKP) (“StrikePoint” or the Company) is pleased to announce that it has completed the purchase of an extensive portfolio of properties located in the Yukon from IDM Mining Ltd. (TSX.V:IDM) (“IDM”). Terms of the Transaction: StrikePoint has issued 10.5 million common shares and paid $150,000 in cash to […]